Asset Protection Strategies for Business Owners

The ABCs of Asset Protection Strategies

The Best of Asset Protection Strategies

It happened!

REMOVE THE INCENTIVE TO SUE YOU

It’s all about giving your creditor two (2) options:

The nuts and bolts

REMOVE THE INCENTIVE TO SUE YOU

REMOVE THE INCENTIVE TO SUE YOU

NUT:

NUT:

Ultra Trust® Irrevocable Trust

BOLT:

BOLT:

Derivative Financial Instrument™

Our System

Something this stressful, like a threat of a lawsuit, gets some people so overwhelmed with fear and anxiety that it causes them an inability to take action. They think that if they keep pushing it aside, and bury their head in the sand, that the problem is somehow going to go away on its own.

- Extracting of your money, because he sees an opportunity

- 2. Creating the maximum grief, regardless of cost, because he sees an injustice.

- Offshore trusts typically cost $5-10,000 a year to maintain

- If you have committed a fraudulent transfer, most judges now put you in jail until you comply with a court order to bring the money back into the United States.

Offshore trusts for real estate work even less well:

… Ultra Trust® Irrevocable Trust

… Ultra Trust® Irrevocable Trust

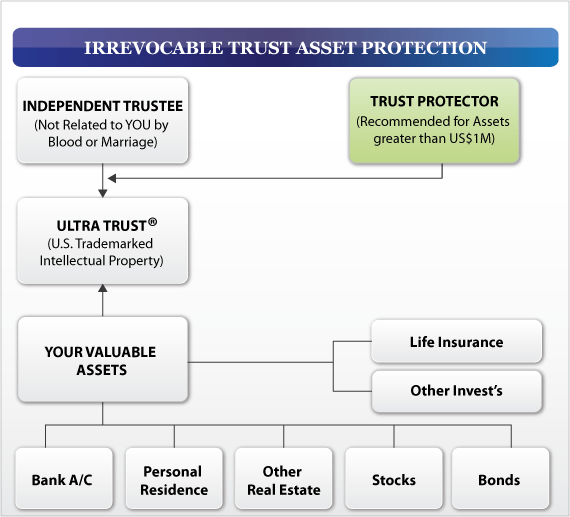

Our Ultra Trust® is an intellectual property right registered with the U. S. Patent Office and one of the best methods available. Financially engineered to remove yourself from the probability of becoming the next creditor victim. This whole website www.ultratrust.com is devoted to the best ways for business owners to safeguard their wealth and the Ultra Trust® Irrevocable Trust has been developed by our expert attorney’s with 30+ years of experience and hundreds of court challenges.

NOTE: Properly implemented, your Social Security Number is not used. The IRS legal entity is separate from its owners. Comprehensive fee for service information / property search brokers will NOT be able to Earn a Fee.

What’s a Trust?

IRREVOCABLE TRUST

IRREVOCABLE TRUSTS ADVANTAGES

WHAT’S A TRUST PROTECTOR? You won’t get this from your lawyer

…Derivative Financial Instrument™

…Derivative Financial Instrument™

Avoiding Fraudulent Transfers: Derivative Financial Instrument

The Derivative Financial Instrument™ is a financial intermediation of a contractual method of [E]xchange in money or money’s worth, designed and implemented, to avoid fraudulent conveyance claims by a [P]ast; [P]resent; and a [F]uture (not yet born) creditor.

The Derivative Financial Instrument™ is the most critical decisive component to our Ultra Trust®

The Derivative Financial Instrument™ is the most critical decisive component to our Ultra Trust®

…. Our Ultra Trust® is an Irrevocable Grantor Trust under Internal Revenue Code (IRC) 671-679 and IRS Regulation 7701-7 provides one of the absolute best wealth protection approaches. When implemented with an Independent Trustee, and an Independent Trust Protector, secured to a Derivative Financial Instrument™, our Ultra Trust® is financially engineered to avoid Fraudulent Conveyance claims, defend a claim of Civil Conspiracy, eliminate the Probate process, eliminate Estate Taxes, mitigate and eliminate the Medicaid and/or Medicaid state recovery under the Federal Medicaid Act 42 USC 1396 et. Seq., providing you with a secured unchallengeable estate plan that results in one of the strongest wealth protection approaches available.

…. Our Ultra Trust® is an Irrevocable Grantor Trust under Internal Revenue Code (IRC) 671-679 and IRS Regulation 7701-7 provides one of the absolute best wealth protection approaches. When implemented with an Independent Trustee, and an Independent Trust Protector, secured to a Derivative Financial Instrument™, our Ultra Trust® is financially engineered to avoid Fraudulent Conveyance claims, defend a claim of Civil Conspiracy, eliminate the Probate process, eliminate Estate Taxes, mitigate and eliminate the Medicaid and/or Medicaid state recovery under the Federal Medicaid Act 42 USC 1396 et. Seq., providing you with a secured unchallengeable estate plan that results in one of the strongest wealth protection approaches available. Unchallengeable Estate Plan: The Ultra Trust® combined with the Derivative Financial Instrument is One of the Strongest Methods for Business Owners

Unchallengeable Estate Plan: The Ultra Trust® combined with the Derivative Financial Instrument is One of the Strongest Methods for Business Owners

- Estate Planning

- Gift Taxes

- Intentionally Defective Grantor Trust (IDGT)

- Grantor Retained Annuity Trust (GRAT)

- Grantor Retained Unitrust (GRUT)

- Commercial Annuity

- Private Annuity

- Installment Sale

- Self-Canceling Installment Note (SCIN)

- Treasury General Counsel’s Memorandum (GCM) 3953, May 7, 1986

- Estate of Moss v. Commissioner, T.C. 1239 (1980) acq. in result, 1981-2 C.B.1

- Estate of Costanza v. Commissioner, T.C. Memo 2001-128; reversed and remanded

- 6th Circuit, No. 01-2207, February 18, 2003

- Estate of Frane v. Commissioner, 998 F. 2nd (8th Circuit 1993)

- Lazarus v. Commissioner, 58 TC 854, August 17. 1972

- Estate of Musgrove, 33 Fed Cl. 657 (1995)

- Estate of Kite, T.C. Memo. 2013-43

- Estate of William M. Davidson, U.S. Tax Court Docket No. 013748-13

- United States v. Davis, 370 U.S. 65 (1962)

- International Freighting Corp. v. Commissioner, 135 F.2d310 (2nd Cir. 1943),

- United States v. General Shoe Corp., 282 F.2d 9 (6th Cir. 1960);

- Wood v. Commissioner, 39 T.C. 1 (1962)

- CCA 201330033; Treas. Reg. § 25.2512-8

- Revenue Ruling 80-80, 1980 1 C.B. 194

- Revenue Ruling 55-119, 1955 – 1 C. B. 352

- Revenue Ruling 86-72, 1 C.B. 253

- Revenue Ruling 68-392, 1968 -2 C. B. 284; and 69-74, 1969-1 C. B. 43

- Treasury Regulation 1.1275 4(c); (j); and § 25.7520-3

- Treasury Regulations § 1.72-6(e); and 1.1001-1(j), October 2006

- Life expectancy (determined under Reg. 1.72-9, Table V)

- Federal Medicaid Act 42 USC 1396 et. Seq.

- Internal Revenue Code (IRC) 72; and (IRC) 7520

Cordially